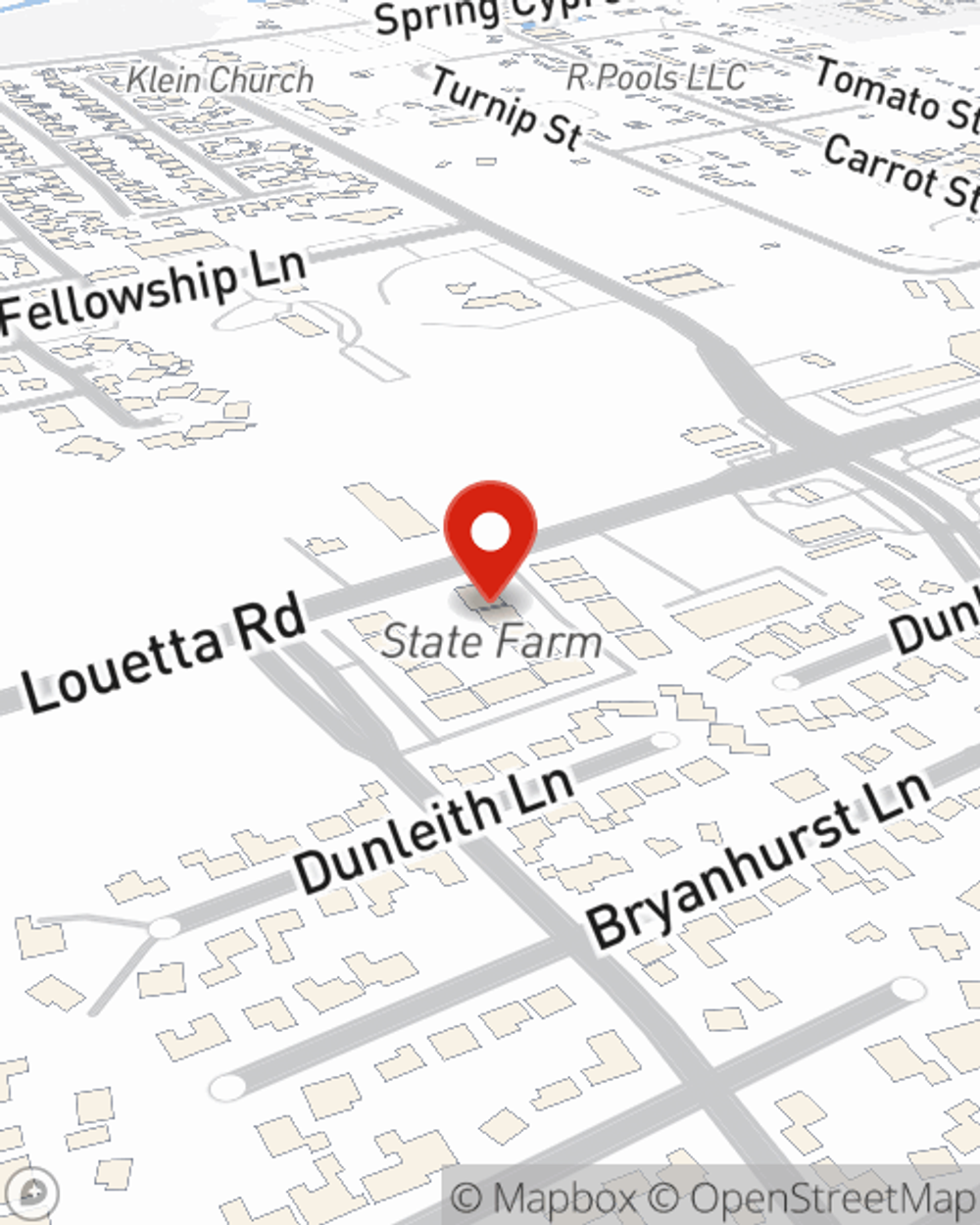

Renters Insurance in and around Spring

Your renters insurance search is over, Spring

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Tomball

- Houston

- Spring

- Cypress

- Magnolia

- The Woodlands

- Humble

- Deer Park

- Katy

- Pasadena

Insure What You Own While You Lease A Home

It may feel like a lot to think through your sand volleyball league, family events, managing your side business, as well as providers and savings options for renters insurance. State Farm offers straightforward assistance and unbelievable coverage for your clothing, swing sets and souvenirs in your rented home. When mishaps occur, State Farm can help.

Your renters insurance search is over, Spring

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

You may be wondering: Is renters insurance really necessary? Just pause to consider the cost of replacing your belongings, or even just one high-cost item. With a State Farm renters policy in your corner, you won't be slowed down by thefts or accidents. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've stored in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Robin Griffith can help you add identity theft coverage with monitoring alerts and providing support.

As a dependable provider of renters insurance in Spring, TX, State Farm is committed to keeping your valuables protected. Call State Farm agent Robin Griffith today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Robin at (281) 376-5511 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Robin Griffith

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.